Introduction

The global automotive industry is undergoing a transformative shift towards sustainability, driven by advancements in technology, environmental concerns, and changing consumer preferences. Electric vehicles (EVs) have emerged as a cornerstone of this shift, offering a cleaner and more efficient alternative to traditional internal combustion engine vehicles. The Middle East, traditionally known for its abundant oil reserves and reliance on fossil fuels, is increasingly exploring the potential of EVs. This essay provides a comprehensive analysis of the electric vehicle market in the United Arab Emirates (UAE), Saudi Arabia, Egypt, and other Middle Eastern countries, focusing on market capacity, development trends, brand market shares, and the competitive advantages of Chinese electric vehicles in the region. cnautozone-car expert

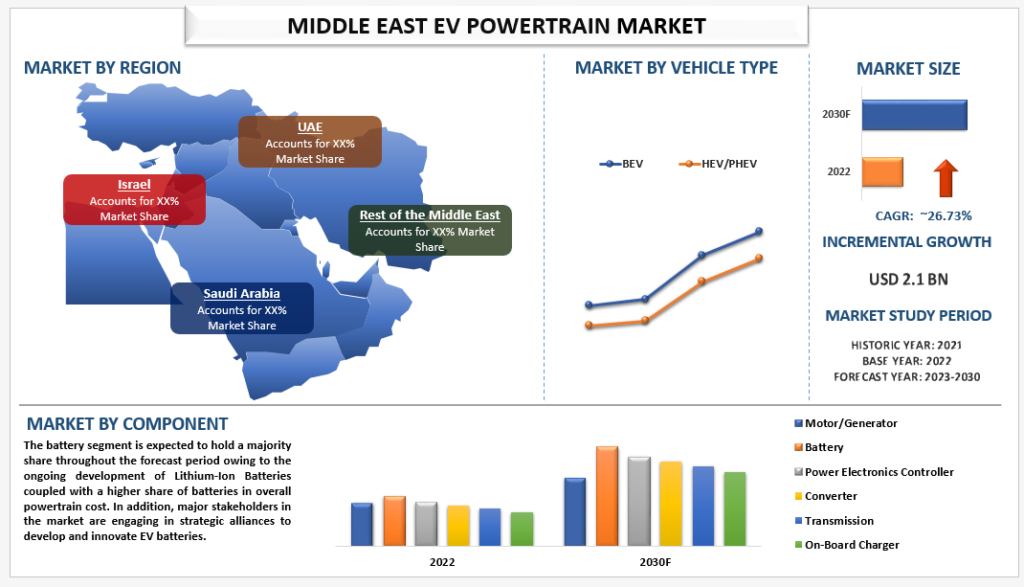

Market Capacity

United Arab Emirates (UAE)

The UAE is at the forefront of EV adoption in the Middle East, leveraging its progressive policies and infrastructural development to foster growth in the sector. The government’s commitment to sustainable development is evident in initiatives like the UAE Vision 2021 and Dubai Clean Energy Strategy 2050, which aim to increase the contribution of clean energy and reduce carbon emissions.

The market capacity for EVs in the UAE is expanding, supported by:

- Government Incentives: Exemptions from registration fees and renewal fees for EV owners.

- Infrastructure Development: Installation of charging stations across major cities. The Dubai Electricity and Water Authority (DEWA) has established numerous charging stations under the “Green Charger” initiative.

- Public Awareness Campaigns: Efforts to educate the public on the benefits of EVs.

Saudi Arabia

Saudi Arabia is embracing electric mobility as part of its Vision 2030 plan to diversify the economy and reduce dependence on oil revenues. The country’s large population and high vehicle ownership rates present significant market capacity for EVs.

Key factors influencing market capacity include:

- Strategic Investments: The Public Investment Fund (PIF) has invested in leading EV manufacturers like Lucid Motors, which plans to establish a manufacturing facility in the country.

- Regulatory Frameworks: Introduction of standards and regulations to facilitate the import and use of EVs.

- Infrastructure Projects: Plans to develop charging infrastructure in urban centers and along major highways.

Egypt

Egypt’s burgeoning population and rapid urbanization make it a promising market for EVs. The government is taking steps to modernize the transportation sector and address environmental challenges.

Market capacity expansion is driven by:

- Policy Support: Incentives for EV imports, reduction of customs duties, and tax exemptions.

- Local Manufacturing Initiatives: Agreements with international manufacturers to produce EVs domestically, enhancing affordability and job creation.

- Infrastructure Development: Pilot projects for charging stations in Cairo and other major cities.

Other Middle Eastern Countries

Countries like Jordan, Kuwait, and Qatar are also exploring opportunities in the EV market:

- Jordan: One of the early adopters, with incentives for EV ownership and a growing charging network.

- Kuwait and Qatar: Investing in infrastructure and considering policy measures to encourage EV adoption.

Development Trends

Several key trends are shaping the EV market in the Middle East:

- Policy and Regulatory Support Governments are implementing policies to promote EV adoption, including:

- Financial Incentives: Subsidies, tax reductions, and exemptions.

- Regulation Updates: Establishing standards for EVs and charging infrastructure.

- Environmental Targets: Setting goals for emission reductions and renewable energy integration.

- Infrastructure Expansion Development of charging infrastructure is critical:

- Public Charging Stations: Installation in accessible locations such as shopping centers, parking lots, and highways.

- Private Partnerships: Collaboration with private companies to expand the charging network.

- Technological Advancements: Adoption of fast-charging technologies to reduce charging times.

- Local Production and Assembly Encouraging local manufacturing to reduce costs and stimulate the economy:

- Joint Ventures: Partnerships between local firms and international EV manufacturers.

- Investment in R&D: Establishing research centers to innovate in EV technology.

- Supply Chain Development: Building a domestic supply chain for components and batteries.

- Consumer Awareness and Acceptance Increasing public understanding of EV benefits:

- Education Campaigns: Highlighting cost savings, environmental benefits, and technological features.

- Test Drive Events: Allowing consumers to experience EVs firsthand.

- Addressing Misconceptions: Providing accurate information to dispel myths about EV performance and reliability.

- Integration with Renewable Energy Aligning EV adoption with renewable energy strategies:

- Solar Charging Stations: Utilizing solar power for charging infrastructure.

- Smart Grids: Implementing energy management systems to optimize charging and grid load.

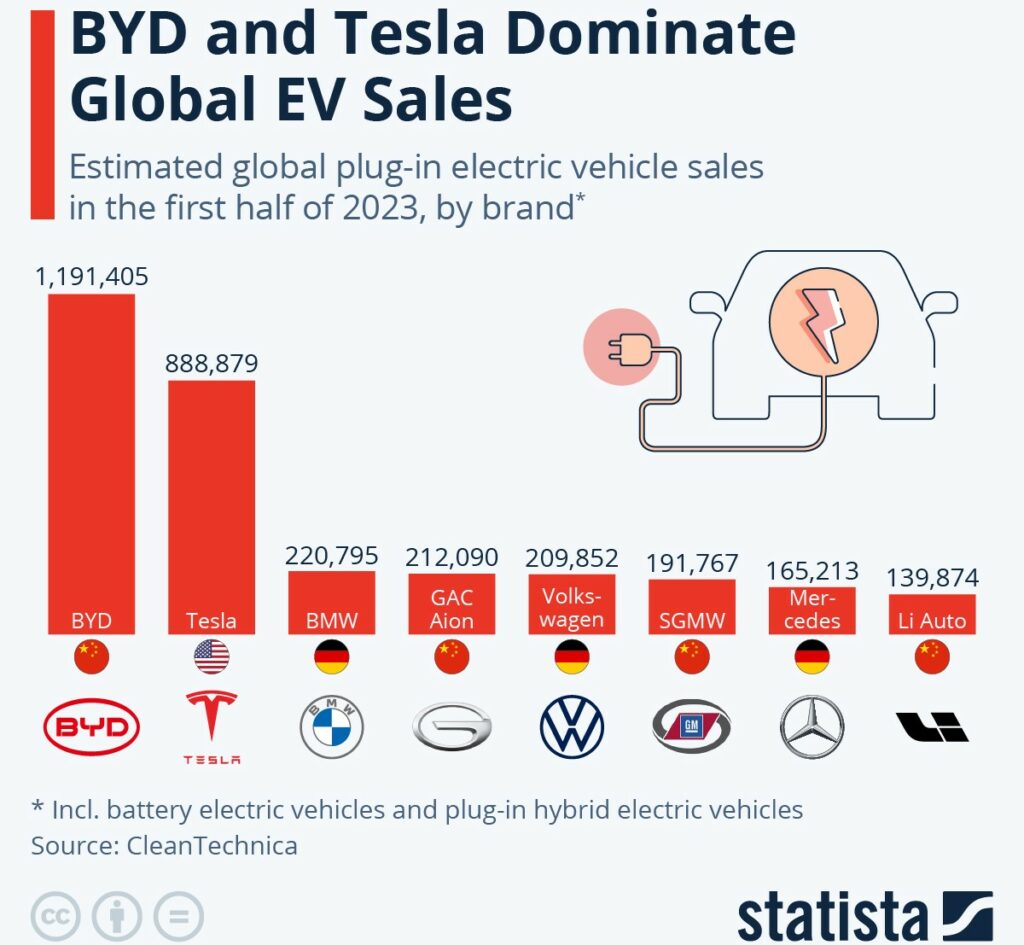

Brand Market Shares

The EV market in the Middle East features a mix of international and emerging players:

International Brands

- Tesla: A pioneer in the EV industry, Tesla has established showrooms and service centers in the UAE and is expanding its presence. Its premium models attract high-end consumers.

- Nissan: The Nissan Leaf is one of the world’s best-selling EVs and is available in several Middle Eastern markets.

- BMW and Mercedes-Benz: Offering luxury EV models like the BMW i series and Mercedes EQ series to cater to affluent customers.

Chinese Brands

Chinese manufacturers are gaining traction due to competitive pricing and advanced technology:

- BYD: Offers a range of EVs and has been involved in projects to supply electric buses and taxis.

- NIO and Xpeng: Known for cutting-edge technology, these brands are exploring market entry strategies in the Middle East.

- SAIC Motor (MG): The MG ZS EV has been introduced in markets like the UAE and has received positive feedback for its affordability and features.

Emerging Local Brands

- Lucid Motors: Backed by Saudi investment, planning to produce luxury EVs with manufacturing facilities in the country.

- Other Ventures: Local companies are exploring opportunities to develop homegrown EV brands, fostering innovation and employment.

Market Share Dynamics

- Premium Segment Dominance: Currently, the market is dominated by luxury brands due to higher income levels in certain countries.

- Emerging Affordable Options: Introduction of mid-range and budget-friendly models is expected to broaden the market.

- Fleet and Commercial Use: Adoption of EVs in public transport and fleet services is increasing, influencing overall market shares.

Advantages of Chinese Electric Vehicles

Chinese EV manufacturers offer several advantages that position them favorably in the Middle Eastern market:

- Cost-Effectiveness

- Competitive Pricing: Chinese EVs are generally more affordable due to economies of scale and cost-efficient manufacturing processes.

- Value Proposition: Offering advanced features and technology at lower price points compared to Western counterparts.

- Technological Innovation

- Battery Technology: Leading in battery development, including advancements in lithium-ion and solid-state batteries.

- Connectivity and AI: Incorporation of smart features, autonomous driving capabilities, and integration with mobile technologies.

- Production Capacity

- Scale of Operations: Ability to meet large orders and supply demands due to extensive manufacturing facilities.

- Rapid Deployment: Quick turnaround times in bringing new models to market.

- Strategic Partnerships

- Joint Ventures: Willingness to enter partnerships with local companies, facilitating market entry and compliance with regional regulations.

- Customization: Ability to tailor vehicles to meet specific market needs, including adaptations for climate and consumer preferences.

- Government Support

- Export Incentives: Support from the Chinese government in promoting international trade and expansion of EV exports.

- Financing Solutions: Provision of flexible financing options to distributors and consumers.

- After-Sales Services

- Comprehensive Support: Establishing service centers and providing warranties to build consumer trust.

- Training Programs: Offering technical training to local workforce for maintenance and support.

-

byd han ev$24,204.00 – $33,033.00

byd han ev$24,204.00 – $33,033.00 -

促销产品

aion Y plus ev suv$13,600.00 – $19,416.00

aion Y plus ev suv$13,600.00 – $19,416.00 -

促销产品

aion s max ev$19,172.00 – $22,703.00

aion s max ev$19,172.00 – $22,703.00

Conclusion

The Middle East is at a pivotal point in embracing electric mobility, with significant potential for growth in the EV market. The UAE, Saudi Arabia, and Egypt are leading efforts to increase EV adoption through supportive policies, infrastructure development, and public awareness initiatives. The region’s market capacity is enhanced by a young, tech-savvy population and a growing environmental consciousness.

Brand dynamics are evolving, with international luxury brands currently holding significant market share. However, the entry of Chinese EV manufacturers presents a shift towards more affordable and technologically advanced options. Chinese EVs possess competitive advantages in pricing, innovation, and adaptability, making them strong contenders in the Middle Eastern market.

For sustained growth, continued collaboration between governments, manufacturers, and stakeholders is essential. Investments in infrastructure, consumer education, and local industry development will be critical in overcoming challenges and realizing the full potential of the EV market in the Middle East. The transition to electric vehicles not only aligns with global sustainability goals but also offers economic diversification and advancement opportunities for the region. cnautozone-car expert

References

- UAE Vision 2021 and Dubai Clean Energy Strategy 2050 documents.

- Public Investment Fund (PIF) announcements regarding investments in Lucid Motors.

- Ministry statements and policy documents from the UAE, Saudi Arabia, and Egypt regarding EV incentives and infrastructure plans.

- Industry reports on the Middle Eastern automotive market trends and EV adoption rates up to October 2023.

- Press releases from Chinese EV manufacturers outlining their international expansion strategies.